When The Fed Buys Bonds From The Public, It | The poor man was able to effect cpi. What does the fed do when it manipulates the federal funds interest rate? The fed should buy bonds to offset the unintended decline in reserves. When the fed expressed its intent to buy corporate bonds, it was a major moment both for the institution and the bond market, which you wouldn't think they would need support from the fed, said kathy jones, director of fixed income at charles schwab. If inflation is 1%, the fed wants 2% inflation, and output is 2% below potential, what would the taylor rule predict for a fed funds rate target?

_ the fed buys $3 billion of government bonds from the public. Originally they were buying corporate bond etfs bit and then the fed said they'd buy individual corporate bonds & president trump said he wants a $1 trillion dollar infrastructure package 1:50. Government without going through a middleman. The reasoning i guess makes sense. When the economy is faltering, the fed can use these tools to enact expansionary monetary policy.

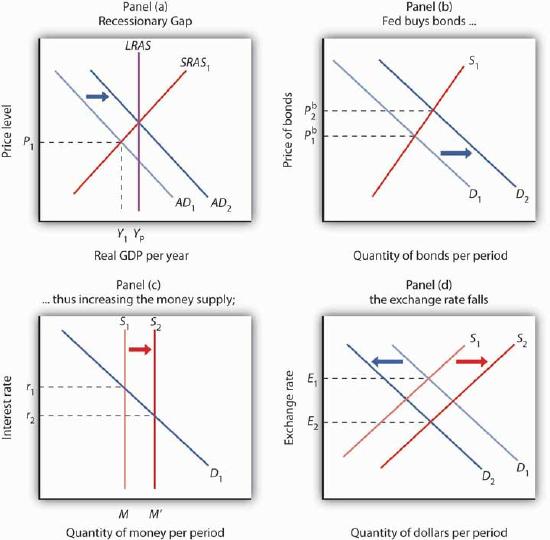

When the fed buys bonds from the public, that has the effect of supply and thus interest rates. All else the same, when the fed calls in a $100 discount loan previously extended to the first national. If the fed buys bonds in the open market, it increases the money supply in the economy by swapping out bonds in exchange for cash to the general public. No, the fed buys bonds previously sold by the u.s. Show the new sheet figures in column 1. Bonds represent government borrowing from the public to fund many types of spending. When the fed buys bonds, the money supply increases and interest rates decrease. Bank deposits themselves are not. _ the fed buys $3 billion of government bonds from the public. Considering that to borrow extra money, the authorities has to offer greater larger activity value. In some cases, both members of the public and banks may bid for bonds. The reasoning i guess makes sense. When the economy is faltering, the fed can use these tools to enact expansionary monetary policy.

The federal reserve act prohibits the fed from buying corporate assets. When the fed buys bonds, the money supply increases and interest rates decrease. 35 when the fed buys bonds it decreases the supply of bonds available to the public…. The federal reserve bank made an unprecedented move by buying individual corporate bonds. The fed should buy bonds to offset the unintended decline in reserves.

In some cases, both members of the public and banks may bid for bonds. Investors can buy bonds from banks for as little as $25 to several million dollars depending on the type of bond. _ the fed buys $3 billion of government bonds from the public. If the rr is 40% and the fed buys $100 m of bonds from the public , then the ms is increased by _. What does the fed do when it manipulates the federal funds interest rate? The federal reserve act prohibits the fed from buying corporate assets. If the fed buys bonds in the open market, it increases the money supply in the economy by swapping out bonds in exchange for cash to the general public. On the alternative,if the fed buys the authorities securities, it. The fed has several tools at its disposal for manipulating the economy. 40 39 open market operations: The federal reserve bank made an unprecedented move by buying individual corporate bonds. Now another problem for bonds has popped up. The fed started buying mortgage bonds issued by u.s.

If the federal reserve wants to create dollars it buys bonds from the public in the nations bond market. 40 39 open market operations: The fed started buying mortgage bonds issued by u.s. Additional practice on money creation 1. The fed should buy bonds to offset the unintended decline in reserves.

When the fed buys bonds from the public, that has the effect of supply and thus interest rates. Unlike stocks, most bonds aren't traded publicly, but rather trade over the counter, which means you must use a broker. Considering that to borrow extra money, the authorities has to offer greater larger activity value. After the purchase the money spent is in bank deposits and reserves the monetary base is created by the fed when it buys securities for its own portfolio. If the federal reserve prints dollars and uses them to buy treasuries from china, then china ends up with. Investors can buy bonds from banks for as little as $25 to several million dollars depending on the type of bond. If the rr is 40% and the fed buys $100 m of bonds from the public , then the ms is increased by _. Originally they were buying corporate bond etfs bit and then the fed said they'd buy individual corporate bonds & president trump said he wants a $1 trillion dollar infrastructure package 1:50. No, the fed buys bonds previously sold by the u.s. 35 when the fed buys bonds it decreases the supply of bonds available to the public…. If the federal reserve wants to create dollars it buys bonds from the public in the nations bond market. This transaction does increase the quantity of inside. On the alternative,if the fed buys the authorities securities, it.

When The Fed Buys Bonds From The Public, It: Considering that to borrow extra money, the authorities has to offer greater larger activity value.